Are you Saving for a Home , your tax refund is a good start.

Are You Saving Up To Buy a Home? Your Tax Refund Can Help

You’ve been working on your savings and dreaming of that moment when you finally have keys to a place that’s truly yours. What you might not realize is that your tax return could give you a little extra cash to help you get there sooner. As Freddie Mac notes:

“ . . . your tax refund from the IRS can be a useful supplement to your homebuying budget.”

So, if you’re getting a tax refund this year, you can use it to help you pay for some of the upfront costs that come with buying a home, like the down payment and closing costs. And here’s the best part.

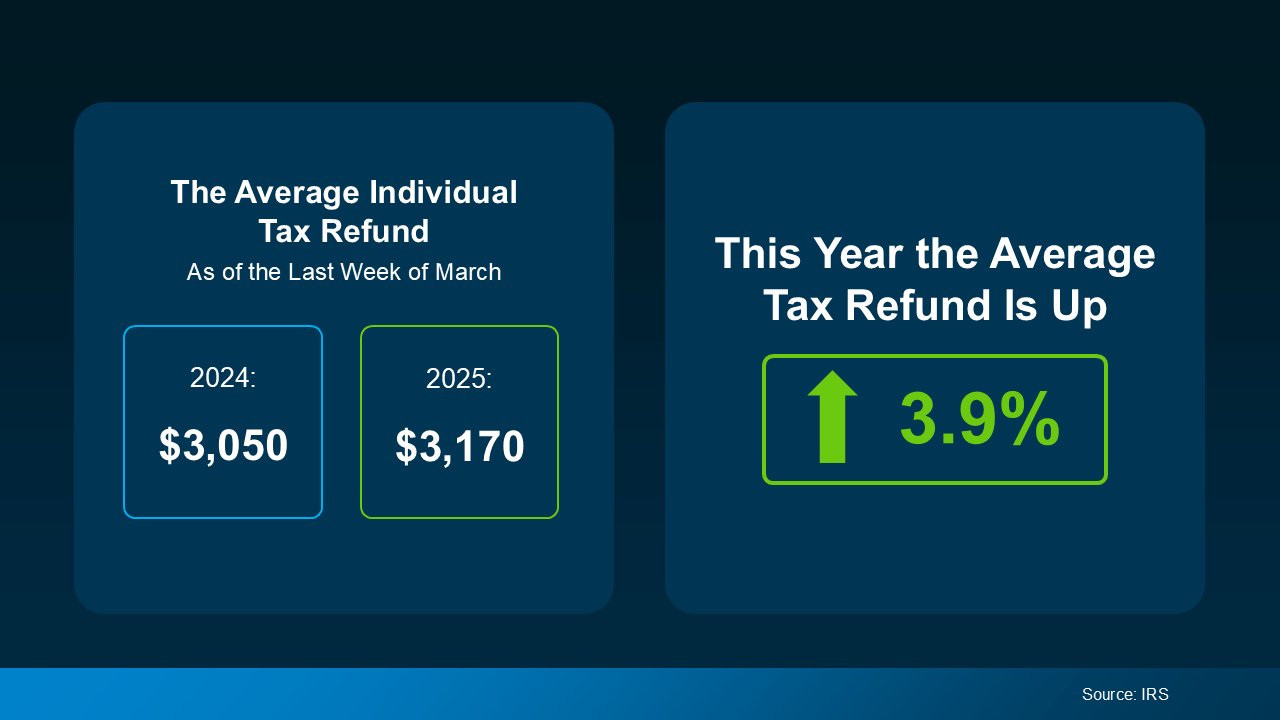

On average, people are getting even more money back in their refunds than they did last year. While it’s not a big increase, the visual below uses data from the Internal Revenue Service (IRS) to show the average individual’s refund is 3.9% higher this year:

Of course, how much money you may get in your tax refund is going to vary. But when it comes to buying a home, any extra cash can help move things forward. Here are a few examples of how you can put that money to good use, according to Freddie Mac:

- Save for a down payment – Saving for a down payment can be one of the biggest hurdles for buyers. Setting aside your tax refund for this expense could help you get to your goal faster. Just remember, it’s typically not required to put 20% down.

- Pay for closing costs – Closing costs include fees for things like the appraisal, title insurance, and underwriting of your loan. They’re generally between 2% and 5% of the total purchase price of the home. So, putting your refund toward these costs can make things more manageable on closing day.

- Lower your mortgage rate – Your lender might give you the option to buy down your mortgage rate. If you qualify for this option, you could pay up front to have a lower rate on your mortgage. If affordability is tight for you at today’s rates and home prices, this may be worth exploring.

But you don’t have to figure it all out on your own. Working with a team of trusted real estate professionals who understand the homebuying process, what you need to save, and any resources you can tap into will help you make sure you’re ready to buy when the time comes.

When it comes to saving for a home, every dollar gets you one step closer to your goal. While your tax refund may not be enough to change the game, it can help give your homebuying fund a boost.

What would having your own home mean for you or your family this year? Let’s talk about it and we’ll come up with a strategy for success.

Are You Saving Up To Buy a Home? Your Tax Refund Can Help

Spring is in the air—and so is tax season. While it might not inspire the same excitement as blooming flowers or beachside weekends, your tax refund holds a powerful secret: it could be the very thing that turns your dream of having your own home into a reality. If you’re saving up to buy a home, this annual windfall is more than just a bonus—it’s a strategy for success.

Whether you’re eyeing your very first nest or upgrading to a place that fits your growing dreams, putting that refund to work is one of the smartest financial moves you can make. Let’s explore how your tax refund can help you lay the foundation for a future rooted in homeownership—and how it fits snugly into your homebuying budget.

1. A Windfall With Purpose: Turn That Refund Into Real Estate

Every year, the IRS returns billions of dollars to American taxpayers in the form of tax refunds. For many households, this money becomes a golden opportunity to knock down barriers to buying a home—especially when paired with the guidance of real estate professionals and local mortgage lenders in West Palm Beach who know the ropes.

Instead of spending that refund on a quick vacation or the latest tech gadget, why not use it to give your homebuying fund a boost?

Here’s how it can make a monumental difference:

-

Supplement your down payment

-

Cover closing costs

-

Buy down your mortgage rate

-

Pay for title insurance or an appraisal

-

Strengthen your profile for the underwriting of your loan

These are real, tangible steps toward saving for a home that last longer than any shopping spree.

2. The Down Payment Power Play

For many, saving for a down payment feels like trying to fill a swimming pool with a teaspoon. It’s slow, it’s painful, and it feels like you’ll never get there. But imagine throwing a few buckets in at once—that’s the effect your tax refund can have.

Whether you’re planning to put down 20% or going with one of the first time home buyer loans in West Palm Beach that allows for a smaller percentage, adding even $2,000–$5,000 from a refund can dramatically change your affordability situation. In fact, Freddie Mac reports that the average down payment among first-time buyers is only 6–7%. That’s achievable with some smart saving and a well-used refund.

3. Closing Costs: The Hidden Hurdle

Let’s talk about the sneaky expenses that catch many buyers off guard—closing costs. These include fees for appraisal, title insurance, underwriting, and a handful of other necessary services. On average, closing costs run about 2–5% of the purchase price of a home.

Using your tax refund to cover these fees ensures you’re not draining your emergency savings or dipping into funds earmarked for furnishing or moving. It’s a practical way to keep your financial future secure while still progressing through the homebuying process with confidence.

4. The Great Rate Reduction: Buy Down Your Mortgage Rate

Want to have a lower rate on your mortgage? Use your refund to buy down your mortgage rate through points. It’s a savvy move for buyers looking to reduce their monthly payment and increase their long-term affordability.

In a world where mortgage rate fluctuations can make or break your monthly budget, every fraction of a percent counts. Just a 0.25% decrease in your mortgage rate could save you thousands over the life of your loan.

And if you’re working with a West Palm Beach mortgage broker who knows how to navigate the nuances of rate negotiation, you’re already ahead of the game.

5. Align Your Tax Refund With Your Homebuying Budget

Creating your homebuying budget isn’t just about choosing a number that “feels right.” It’s a financial roadmap. By folding your tax refund into the equation, you’re not just stretching your dollars—you’re strengthening your buying position.

Here’s what that might look like:

-

You increase your down payment, which lowers your monthly mortgage rate

-

You can afford a slightly higher purchase price

-

You pad your emergency fund post-closing

-

You offset appraisal and underwriting fees without dipping into savings

Now, instead of limiting your home search to a tight range, you’re walking in with greater leverage and peace of mind.

6. Partner With a Team of Trusted Real Estate Professionals

Maximizing your tax refund starts with having the right team behind you. That includes:

-

A sharp West Palm Beach mortgage broker

-

An agent who understands home prices in your market

-

An expert in affordable West Palm Beach home loans

-

Lenders who provide clear guidance on mortgage preapproval in West Palm Beach

With the right team, you’ll know exactly where your refund dollars will go the farthest—and how to apply them to each step in the home buying journey.

7. Tools, Calculators, and Confidence

A solid plan starts with solid data. Before making any moves, run the numbers using West Palm Beach mortgage calculators. These tools will show you:

-

How much home you can afford

-

What your monthly payments will look like

-

How your tax refund impacts your homebuying budget

With this clarity, you’re not guessing—you’re acting with intention.

8. Saving For A Home vs. Shopping For One

It’s tempting to start scrolling through listings before your finances are fully in place. But smart buyers know that saving for a home is just as important as choosing the right one.

That’s where your refund swoops in to save the day. Think of it as the bridge between dreaming and doing.

Before stepping into open houses or calling agents, make sure your refund is securely tucked into:

-

A high-yield savings account earmarked for your homebuying process

-

A fund designated solely for your down payment or closing costs

-

A prepayment toward your West Palm Beach refinancing options if you’re a repeat buyer

9. Embrace the Market, Don’t Fear It

Yes, home prices may fluctuate. Yes, mortgage rate shifts can be unpredictable. But with the right preparation and use of your tax refund, you’re positioned to act wisely in any climate.

You’re not just reacting to the market—you’re entering it with strategy, clarity, and purpose.

And in West Palm Beach, where sunshine and opportunity collide, being a prepared buyer gives you a serious edge—whether you’re purchasing your first condo downtown or looking for a single-family oasis near the coast.

10. Long-Term Thinking: This Is Just The Beginning

Having your own home isn’t just about the purchase—it’s about what comes after.

It’s about:

-

The pride of homeownership

-

Building equity

-

Creating stability for yourself or your family

-

Setting roots in a community

Using your tax refund to take the first step means you’re planting a seed that will grow for decades to come. It’s not just a deposit—it’s a declaration of intent.

And when you look back in a few years, you won’t remember the gadget you didn’t buy or the trip you didn’t take. You’ll remember the moment you decided to build something permanent.

11. Business Buyers: This Applies to You, Too

If you’re looking into a storefront, office, or rental space, don’t skip this part. Your tax refund can also be applied toward commercial mortgage broker in West Palm Beach services or fees associated with property acquisition. Whether it’s assisting with underwriting, appraisal, or negotiating a better deal through strategic cash reserves, those funds are versatile.

Just like residential buyers, commercial buyers can use their refunds to unlock better affordability and cleaner transactions.

12. Don’t Wait for Next Year’s Refund—Start Today

If you’ve already received your refund this year, great—let’s put it to work. If not, use this as your call to action. Start mapping out how next year’s refund will be used in your homebuying process.

Here’s how:

-

Set a goal: How much of your refund will you set aside?

-

Create a savings category: Label it “Saving up to buy a home“

-

Talk to your lender about how refund savings can strengthen your application

-

Schedule a consult with a West Palm Beach mortgage broker to outline your next move

By the time your next refund lands, you’ll be ready—not just hopeful.

Conclusion: From Refund to Front Door

This year, your tax refund can be more than a nice surprise. It can be your launchpad into homeownership. With the right plan, the right people, and a dose of discipline, you can turn that annual check from the IRS into keys jingling in your pocket.

Your tax refund can help you take one bold step closer to the life you’ve imagined. Whether it’s a cozy condo in downtown, a family-friendly suburb, or a sleek commercial space—this is your moment to make a move.

Take the refund. Take the leap. Take the door that leads to having your own home.

Are you looking to Buy or Sell a Home in Denver?

Ready to sell your home quickly and at the right price? Find out how much your home is worth now!

If you’re looking for a new home in Denve CO we can help. Use these popular one-click searches to find what you’re looking for: